All Categories

Featured

Table of Contents

- – Unmatched Accredited Investor Passive Income P...

- – Trusted Accredited Investor Alternative Asset ...

- – Expert Exclusive Investment Platforms For Acc...

- – Sought-After Accredited Investor Property Inv...

- – World-Class Venture Capital For Accredited I...

- – Best Accredited Investor Property Investment...

It's important to recognize that achieving recognized capitalist standing is not a single achievement. Individuals need to maintain their eligibility by fulfilling the ongoing criteria established by regulatory bodies. Normal evaluation of revenue, total assets, and specialist credentials is essential to make certain continued certification. It's for that reason essential for accredited financiers to be positive in monitoring their economic circumstance and updating their records as needed.

Failure to satisfy the continuous requirements may result in the loss of accredited financier condition and the linked benefits and opportunities. While much of the financial investment kinds for Accredited Investors are the same as those for any person else, the specifics of these financial investments are typically different. Personal placements describe the sale of securities to a choose team of accredited financiers, generally beyond the general public market.

Hedge funds goal to provide positive returns regardless of market conditions, and they frequently have the adaptability to invest across different asset courses. Exclusive equity financial investments, on the various other hand, include investing in privately-held firms that are not publicly traded on stock exchanges. Personal equity funds swimming pool resources from certified financiers to acquire possession risks in firms, with the goal of improving performance and generating substantial returns upon departure, generally through a sale or first public offering (IPO).

Market variations, residential property management obstacles, and the potential illiquidity of property possessions should be meticulously evaluated. The Securities and Exchange Payment (SEC) plays an important role in controling the activities of accredited financiers, who should abide by specifically laid out guidelines and reporting demands. The SEC is in charge of imposing safety and securities legislations and regulations to secure investors and preserve the stability of the monetary markets.

Unmatched Accredited Investor Passive Income Programs

Policy D gives exceptions from the registration needs for sure exclusive placements and offerings. Accredited investors can take part in these excluded offerings, which are usually extended to a minimal number of advanced capitalists. To do so, they need to offer precise details to providers, full necessary filings, and follow the rules that govern the offering.

Conformity with AML and KYC demands is important to keep standing and gain accessibility to numerous investment chances. Falling short to conform with these guidelines can cause extreme penalties, reputational damage, and the loss of accreditation advantages. Allow's disprove some typical mistaken beliefs: A typical misconception is that certified capitalists have actually a guaranteed advantage in terms of financial investment returns.

Trusted Accredited Investor Alternative Asset Investments for Secured Investments

Yes, recognized investors can shed their status if they no longer satisfy the qualification requirements. If an approved capitalist's income or web well worth falls below the designated limits, they might shed their accreditation. It's vital for accredited financiers to frequently assess their monetary circumstance and report any modifications to make certain conformity with the laws

Nonetheless, it depends upon the certain investment offering and the policies regulating it. Some financial investment opportunities may allow non-accredited investors to take part through certain exemptions or arrangements. It's essential for non-accredited capitalists to very carefully review the terms and problems of each financial investment chance to determine their eligibility. Keep in mind, being an approved financier comes with benefits and obligations.

Expert Exclusive Investment Platforms For Accredited Investors with Accredited Investor Support

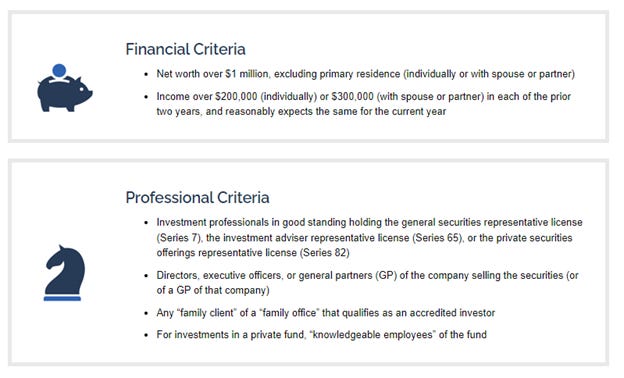

If you desire to buy specific complicated financial investments, the Stocks and Exchange Compensation (SEC) calls for that you be a recognized investor. To be certified, you should meet particular demands regarding your wealth and revenue along with your investment understanding. Have a look at the basic requirements and benefits of ending up being an accredited financier.

The SEC takes into consideration that, as a result of their monetary security and/or investment experience, approved financiers have much less demand for the security supplied by the disclosures called for of managed investments. The guidelines for certification, which have remained in place because the Stocks Act of 1933 was developed as a reaction to the Great Depression, can be located in Regulation D, Guideline 501 of that Act.

Sought-After Accredited Investor Property Investment Deals

That company can't have actually been developed just to buy the unregistered securities in inquiry. These demands of revenue, internet well worth, or professional experience ensure that inexperienced capitalists do not take the chance of cash they can not pay for to lose and don't take financial dangers with financial investments they don't recognize. No actual qualification is offered to verify your standing as a recognized investor.

Neither the SEC neither any other regulative firm is associated with the process. When you look for certified investor status, you're most likely to go through a screening process. You might have to complete a preliminary survey asking about your financial investment background, revenue, and total assets. Files you will probably have to produce might include: W-2s, income tax return, and other papers validating profits over the previous two years Economic declarations and bank declarations to verify net worth Credit scores reports Documentation that you hold a FINRA Collection 7, 64 or 82 designation Paperwork that you are a "well-informed employee" of the entity providing the protections The ability to spend as a "experienced employee" of a fund issuing protections or as a financial specialist holding a proper FINRA certificate is new as of 2020, when the SEC broadened its meaning of and qualifications for recognized capitalists.

World-Class Venture Capital For Accredited Investors for Accredited Investor Opportunities

These protections are non listed and unregulated, so they do not have available the regulative protections of registered securities. In general, these financial investments may be particularly unpredictable or bring with them the potential for substantial losses. They consist of various structured financial investments, hedge fund investments, private equity financial investments, and other private positionings, all of which are unregulated and might carry substantial threat.

Of course, these investments are additionally attractive because in enhancement to included risk, they bring with them the possibility for substantial gains, generally more than those available via average investments. Recognized financiers have readily available to them investments that aren't open up to the basic public. These financial investments consist of personal equity funds, angel investments, specialized financial investments such as in hedge funds, equity crowdfunding, property mutual fund, endeavor resources financial investments, and straight financial investments in oil and gas.

Firms using non listed securities only need to supply documents regarding the offering itself plus the place and police officers of the business using the securities (accredited investor wealth-building opportunities). No application procedure is needed (as is the case with public supply, bonds, and common funds), and any due diligence or extra information given is up to the company

Best Accredited Investor Property Investment Deals for Financial Freedom

This info is not intended to be individual recommendations. Possible participants ought to talk to their personal tax professional pertaining to the applicability and impact of any kind of and all advantages for their own personal tax scenario. On top of that, tax obligation legislations alter every so often and there is no guarantee relating to the interpretation of any tax obligation laws.

Accredited financiers (occasionally called professional financiers) have access to investments that aren't available to the general public. These financial investments might be hedge funds, tough cash lendings, convertible investments, or any various other safety and security that isn't signed up with the financial authorities. In this write-up, we're going to focus especially on property investment alternatives for recognized financiers.

Table of Contents

- – Unmatched Accredited Investor Passive Income P...

- – Trusted Accredited Investor Alternative Asset ...

- – Expert Exclusive Investment Platforms For Acc...

- – Sought-After Accredited Investor Property Inv...

- – World-Class Venture Capital For Accredited I...

- – Best Accredited Investor Property Investment...

Latest Posts

Tax Default Houses

Homes For Sale For Back Taxes

Tax Overages

More

Latest Posts

Tax Default Houses

Homes For Sale For Back Taxes

Tax Overages